Just How Car Insurance Aids Cover Repair Costs and Medical Costs

Wiki Article

Maximize Your Financial Savings: Expert Strategies for Picking Auto Insurance Coverage

Selecting the ideal vehicle insurance is a crucial choice that can substantially affect your monetary well-being. By understanding your distinct insurance coverage needs and systematically comparing different service providers, you can discover possible financial savings that may not be promptly obvious. Discovering these elements might expose possibilities that might transform your technique to insurance coverage savings.Understand Your Insurance Coverage Demands

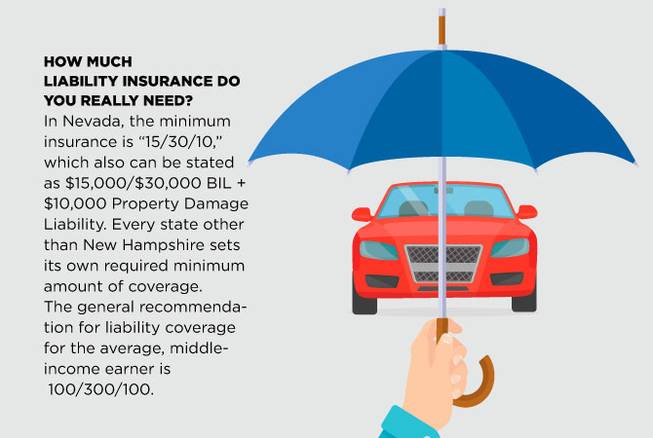

Begin by examining the minimum requirements mandated by your state. While these might offer a baseline, they typically do not use sufficient security in the occasion of a crash. Consider your automobile's worth; newer or high-value vehicles typically need thorough and collision protection to secure against possible losses.

Furthermore, evaluate your driving behaviors. Higher responsibility restrictions may be required to protect against potential insurance claims if you frequently commute or drive in stuffed locations. Alternatively, if your lorry is older and has a reduced market price, you could go with an extra standard plan with lower costs.

Compare Insurance Coverage Companies

When choosing a cars and truck insurance policy supplier, it is vital to perform a complete comparison to discover the very best coverage at one of the most competitive prices. Begin by gathering quotes from several insurance companies, as rates can differ substantially based on elements like your driving history, place, and the kind of coverage you call for. Make use of online comparison tools to enhance this process, allowing you to examine costs and policy functions alongside.Along with cost, it's vital to examine the coverage alternatives offered by each provider. Seek policies that align with your details needs, such as responsibility restrictions, comprehensive protection, and without insurance vehicle driver defense. Consider the monetary security and reputation of the insurance companies you are assessing. Research study client testimonials and ratings to assess their solution quality and asserts dealing with procedure.

Utilize Discounts and Cost Savings

After comparing insurance coverage service providers and choosing possible prospects, the following step involves maximizing your cost savings via readily available discount rates. Many insurers provide numerous price cuts that can considerably decrease your premium. These price cuts might include safe vehicle driver discount rates, multi-policy price cuts, and also student price cuts for young chauffeurs keeping great grades.Furthermore, take into consideration signing up in a telematics program, where your driving behaviors are kept track of, potentially resulting in lower premiums for safe driving actions. Furthermore, preserving a good credit history can also unlock extra savings, as lots of insurers aspect credit report right into their rates models.

It's additionally worth exploring discount rates for car safety and security features, such as anti-lock brakes, air bags, and anti-theft gadgets. Some insurers offer decreases for lorries with a strong safety and security document or those that are eco-friendly, like hybrid or electric cars.

Lastly, do not hesitate to ask your insurance policy provider about any other readily available discounts that may relate to your particular situation. By thoroughly examining and leveraging these discount rates, you can ensure that you get the very best possible price on your auto insurance coverage while preserving sufficient coverage.

Review Your Policy Consistently

Routinely examining your cars and truck insurance plan is important to make certain that you are sufficiently protected and not paying too read the full info here much for protection. Insurance coverage needs can transform gradually as a result of different variables, including changes in your driving habits, car value, or personal situations. By regularly examining your policy, you can determine any type of outdated protection or unneeded add-ons that may inflate your costs.Begin your review by inspecting the coverage limitations and deductibles to ensure they straighten with your existing demands. If you have actually paid off your car, you might select to reduce your collision protection. Furthermore, consider any type of life adjustments, such as marital relationship or relocating to a different location, which can influence your insurance policy prices.

Following, contrast your current plan with other alternatives readily available in the market. Insurance policy companies frequently update their offerings, and you might locate better prices or boosted insurance coverage elsewhere. Lastly, do not hesitate to ask your insurer about potential discounts that might use due to adjustments in your circumstances.

Think About Deductible Options

Choosing the right insurance deductible for your car insurance coverage plan is a crucial decision that can considerably influence your premium costs and out-of-pocket costs. A deductible is the quantity you agree to pay out of pocket before your insurance coverage kicks in to cover the staying Resources costs of an insurance claim. Typically, greater deductibles result in lower regular monthly premiums, while lower deductibles can lead to higher premiums.

When reviewing insurance deductible options, consider your monetary scenario and driving practices (Car Insurance). If you have a stable earnings and can easily cover a greater insurance deductible in the occasion of a mishap, selecting a greater deductible may be advantageous in decreasing a fantastic read your general insurance policy prices. Conversely, if you expect constant insurance claims or have actually restricted cost savings, a reduced deductible may offer you with peace of mind in spite of greater costs

It's necessary to balance the instant financial alleviation of lower costs against the possibility for raised expenses throughout a case. Conduct a thorough evaluation of your driving risk, history, and budget plan resistance. By meticulously selecting an insurance deductible that lines up with your financial abilities, you can maximize savings while preserving adequate coverage.

Verdict

Comprehending your coverage requires is a critical aspect of effective cars and truck insurance coverage administration.When choosing a vehicle insurance policy copyright, it is necessary to carry out a detailed comparison to locate the best coverage at the most competitive rates.Routinely reviewing your cars and truck insurance coverage policy is necessary to guarantee that you are sufficiently safeguarded and not overpaying for protection. Car Insurance. Insurance policy companies often upgrade their offerings, and you could find much better prices or boosted insurance coverage in other places.In verdict, reliable management of automobile insurance costs necessitates a comprehensive understanding of individual protection requirements, attentive contrast of insurance policy suppliers, and usage of offered discount rates

Report this wiki page